Many conservatives are aware of the 2005 Kelo decision, which gave broad latitude to local governments in the use of eminent domain. Conscious Conservatives should be against eminent domain in almost every situation. It is sad that the current President of the United States claims conservative support, yet bragged about using eminent domain as part of his real estate deals. Private property must be respected. There is little abuse of government power greater than using the collective authority to take property from one citizen to give to another.

Another concept that is supported by some conservatives but should be disdained by all is civil asset forfeiture. Originally a means to confiscate stolen property and contraband, government has turned seizing assets into a profit making operation. In some states, a police officer can take your property simply by alleging they have probable cause that a crime might have been committed. State laws, court fees and procedures make getting the property back more costly than the value of the property. In many cases, there has been no crime committed and the person whose property was taken is never charged with a crime. An Arizona case was settled out of court, which means that no precedent will be set. It also means the plaintiffs were unable to get confirmation that seized asses were being used to purchase personal items for police department leaders. Asset Seizures Lawsuit Reaches Settlement

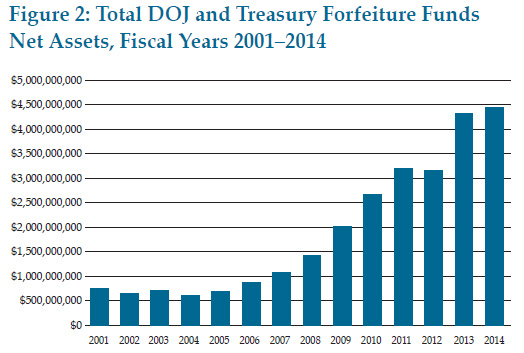

Below is a chart from Mother Jones which shows how asset forfeiture has increased at the federal level.