The ability of the United States Government to continue to provide Social Security benefits and when money will no longer be available to pay those benefits has been a topic of debate for longer than I can remember. Lately, many remedies have been proposed for modifying Social Security. Some of these include means testing, raising taxes on the wealthy and raising the age to receive benefits. Unfortunately, I have not heard a plan to address one of the root causes of the benefit shortfall, inflation.

The problem with inflation is simple if we look at the math. Citizen John Q. Average gets his first job in 1972. At that time, he earns an average salary, about $7500 per year. That also means that he pays an average amount of about $550 per year of social security taxes. Flash forward 40 years. John Q. Average has now reached retirement age and begins taking his Social Security payments. Because of inflation, his first monthly check is over $1200. He receives more money in benefits in his first month than what he paid in his first two years! In his first two years, he will receive as much in benefits as he paid in his first 20 years. Because of the number of people that died before retirement age in the past and the baby boom,Social Security almost got away with this formula. That doesn't work anymore.

Since the time that John Q. Average started working, both wages and Social Security taxes have increased to address the solvency problem. The math still doesn't work. Young Susie Q. Public, who begins work this year, will pay about $2800/yr. in Social Security taxes (including her employer match). If both inflation and Social Security benefits continue over the next 40 years as in the last 40 years, Susie's first monthly payment will be $7200. Again, she will get more in her first month than she paid in her first two years. We could reduce John's and Susie's benefits. John's $1200/month in 2012 probably buys less than his grandfather's $200/month benefit did in 1972, especially of the items seniors buy most, food, fuel and medical care. The problem with that is John and Susie should be able to expect a return after paying for all of those years.

One of the keys to getting Social Security and Medicare costs under control is to control inflation. Without inflation, John would get the same $200/month that his grandfather did. That means that it would take three months for him to get back one year's worth of contributions. His first twenty year's of contributions would make payments for almost five years. By that time, natural attrition would make funding of future payments more likely. As a Conscious Conservative, I can't believe that Social Security will ever be more than a Ponzi scheme unless the government first fixes inflation.

Showing posts with label Social Security. Show all posts

Showing posts with label Social Security. Show all posts

Saturday, March 24, 2012

Friday, April 8, 2011

Conservatives Should Remember The Good Old Days

|

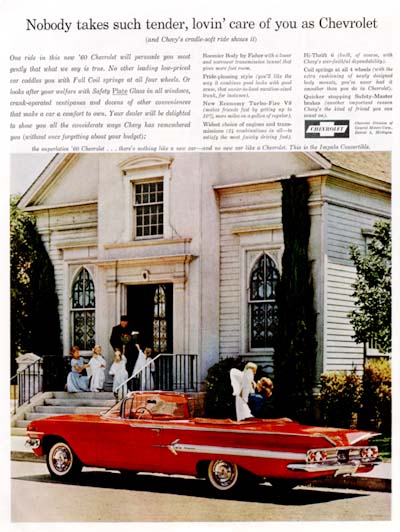

| 1960 Chevy Impala-One Sweet Ride |

One piece of false propaganda that seems to permeate the current federal budget talks is that programs cannot be cut because they have existed forever. This view is spread by liberals and

In 1960, the federal budget was about $92 Billion. In 2010, the federal government spent about $3.46 Trillion. Let's look at that.

conservatives alike. Agency web sites give false histories that make them seem much older than they truly are. The Department of Health and Human Services, established in 1980, tells its history as beginning in 1798 with "Passage of an act for the relief of sick and disabled seamen." This false statement of antiquity is used to make the department seem more vital and indispensable. In fact, many programs and cabinet level departments did not exist 50 years ago. Although 50 years may seem like long ago, given that the United States is over 200 years old, it's really not that long ago and definitely not forever.

In 1960, the federal budget was about $92 Billion. In 2010, the federal government spent about $3.46 Trillion. Let's look at that.

1960 $92,000,000,000

2010 $3,460,000,000,000

That is a lot more money!! More than $3.3 trillion more!!

The proposed 2012 budget for the Department of Transportation, established 1966, is larger than the ENTIRE federal budget in 1960. Some programs that didn't exist in 1960 include Public Broadcasting, Medicare, Head Start, the National Endowments for the Arts and Humanities, Food Stamps and the DEA. Some of the cabinet level departments that didn't exist are the Departments of Transportation, Energy, Health and Human Services, Homeland Security and Housing and Urban Development. Just cutting these historically new departments will save about $1.2 Trillion from the 2012 budget.

The proposed 2012 budget for the Department of Transportation, established 1966, is larger than the ENTIRE federal budget in 1960. Some programs that didn't exist in 1960 include Public Broadcasting, Medicare, Head Start, the National Endowments for the Arts and Humanities, Food Stamps and the DEA. Some of the cabinet level departments that didn't exist are the Departments of Transportation, Energy, Health and Human Services, Homeland Security and Housing and Urban Development. Just cutting these historically new departments will save about $1.2 Trillion from the 2012 budget.

Was the United States really that bad of place in 1960? I don't think so. We should remember the "Good Old Days" and dig into all of these new programs. There are questions that should be asked. Did a permanent problem exist? Does this program solve that problem? Does this program not cause any other problems that are worse than the problem the program solves? Is this program constitutional? If the answers to all these questions are not a resounding yes, we should abolish the program.

Remember that almost every program that the politicians say is "sacred" is relatively new when looking at the history of the United States. Many have not been in existence for 50 years and a lot of programs didn't even exist when you were young. Life wasn't all that bad then and most government programs don't make things better now. Remember the "good old days" and educate the Liberals who say,"It's been this way forever."

Remember that almost every program that the politicians say is "sacred" is relatively new when looking at the history of the United States. Many have not been in existence for 50 years and a lot of programs didn't even exist when you were young. Life wasn't all that bad then and most government programs don't make things better now. Remember the "good old days" and educate the Liberals who say,"It's been this way forever."

Subscribe to:

Posts (Atom)

-

William F. Buckley Jr., the founder of National Review and a prominent conservative intellectual, had a profound impact on American politica...

-

In the intricate dance of democracy, one of the most nefarious partners to emerge in recent centuries is gerrymandering. Picture this: a sha...

-

In The Road to Serfdom, Nobel Prize winning economist Friedrich Hayek warns against the inevitable failures of central planning and if favor...

ARE YOU A CONSCIOUS CONSERVATIVE?

You may be A Conscious Conservative if you believe: No person or government has a right to take or use a person's property without t...