Saturday, December 14, 2019

The Federal Reserve's Secret Quantitative Easing

The Federal Reserve has went into another round of quantitative easing, but outside of some financial news sources, the press seems to be ignoring it. The Wall Street Journal reported on December 6th that the Fed is increasing its balance sheet to $4.07 trillion dollars. That is putting the balance sheet back to the levels the Fed reported it needed to pull the United States out of the credit crisis created by the housing bubble.

As a quick reminder, quantitative easing is when the Federal Reserve creates excess money to stimulate a shrinking economy and avert a recession. Nobody in the mainstream has been reporting a shrinking economy or looming recession. So why the record easing?

The main reason is that the economy is not humming along as reported. As seen a couple of months ago in A Conscious Conservative, the money market system locked up completely in September. The Federal Reserve had to take immediate action to stop interest rates from going above 10%. Another reason is that the Federal Reserve has kept its primary interest rates so low that they have nowhere to go but up. If they cut them 1/2 % as often as they wanted, the interest rates would be negative by now. A third reason is that the stock market is in its longest bull run in history and people are afraid of what is going to happen when it stops. Stock prices have not been justified by company earnings for most stocks for at least ten years now. It is only the free flow of money that is keeping the market afloat.

How does this easing affect inflation? It doesn't if you are free to calculate inflation using the techniques of the Federal Reserve. Prices are actually pretty stable unless you have to buy food, fuel or housing, People who eat, put gas in their vehicles and pay rent have actually seen a substantial increase in prices over the last 10 years. However, according to the Federal Reserve, the decrease in price for an iPhone 6 more than makes up for that.

Sunday, November 24, 2019

States Fight to Keep Dem/Rep Rigging of Presidential Elections

The Supreme Court has decided to take up an issue that goes to the heart of the United States election process. There have been conflicting rulings, one by a State Supreme Court and another by a Federal Court of Appeals as to whether the votes of presidential electors belong to the electors themselves or to the states.

In the case at hand, the states have tried to penalize the so-called "faithless electors" who voted their conscience in the 2016 election. The appeals are coming from the electors in the State of Washington, who wish not to be penalized, and the State of Colorado, who lost its bid to penalize faithless electors.

23 states have asked the Supreme Court to rule in favor of the states controlling the electoral vote. What this means in reality is that the Republican and Democratic parties wish to keep control of the electoral vote. Since all states but Nebraska and Maine use a system where people vote for a slate of electors that belong to the same party, there is little opportunity for someone outside of the party establishment to become an elector. If you take away an elector's ability to vote in the way they choose, the power monopoly is assured.

A Conscious Conservative believes that electors should be selected without regards to political party membership. Electors should also vote for the candidate which they believe will best serve in the office. No. 68 of the Federalist Papers states that selecting the president should require that "every practicable obstacle should be opposed to cabal, intrigue or corruption." Unfortunately for the United States, the Republican and Democratic parties have become the cabals about which the Founders warned and 23 states are now asking the Supreme Court to condone the corruption.

Monday, November 11, 2019

Texas Voters Enact Income Tax Ban

On November 5th, Texas voters approved a constitutional ban on the personal income tax. This comes at an important time, because other no tax states like Nevada and Alaska have recently had calls to initiate an income tax.

The Texas initiative does not completely ban a future income tax. However, it puts forth a procedure where a vote of 2/3 of both houses plus a majority vote of the people is required to enact a personal income tax. 74% of Texas voters approved the restriction on the income tax.

A Conscious Conservative believes that the rest of the United States should take the lead of Texas. It is past time to repeal the 16th Amendment. More about the proposition can be found here-- Texas Proposition 4--Ballotpedia

Monday, November 4, 2019

Woman Goes Up A Tree To Protest Eminent Domain

In Columbia, Missouri, a group of citizens got together to preserve a section of old growth forest. Called It's Our Wild Nature, the organization purchased 37 acres of forest. The City of Columbia decided that they could do a better job of protecting the forest. They used eminent domain to take the forest from the non-profit.

How will Columbia protect the forest? They are going to cut down the trees. Only government could come to the conclusion that cutting down trees is the best way to preserve a forest. The plan is to turn the nature preserve into a series of urban hiking and biking trails.

So one lone woman named Sutu Forte' is going up a tree in protest. She is refusing to move until she goes to talk to the Columbia Mayor and gets a promise to delay construction. The eminent domain case is still in court. However, the city's right to take the property is not in dispute. What is disputed is that the city does not wish to pay fair market value for the land.

As of the time I write this, Forte' has been up the tree for four days. She has been ordered by a court to come down before the end of today. A Conscious Conservative hopes that others will take up her fight.

Saturday, October 19, 2019

The Day Money Market Interest Hit 10%

The lending interest in the Money Market hit 10%. This was not some anti-inflation movement in the 1980s. It was just last month, September 2019. It didn't last long and didn't get passed to consumers in their money market accounts. It did send reverberations throughout the banking world. Banks in the United States basically ran out of money. The Federal Reserve of New York pumped $125 Billion into the system to restore liquidity.

From the lack of headlines, you would think this is something which happens everyday. It wasn't. Banks don't usually run out of money. $125 billion is still a lot of money. It is the most the Feds have ever released in a quick,emergency fashion.

The suggestions for going forward from this event are more concerning. Historically, banks are only allowed to count money as cash reserves. That is probably why they are called "cash reserves." However, there is allegedly a movement afoot to allow banks to count bonds, specifically US Treasuries, as cash reserves. That will allow banks to lend even more money than currently. If people thought that the credit crisis of the late 2000s was bad, they haven't seen anything yet. If banks are allowed to lend more based on holdings of Treasury bonds and then run into a cash crunch, the logical step will be to cash those bonds. That puts the entire US deficit structure at risk. It could make Treasury bonds near worthless or require the Treasury to put the printing presses on overdrive to pay off the debt.

The United States government has never defaulted on Treasury bonds. If the banks start counting them as cash, that day may come.

Sunday, October 6, 2019

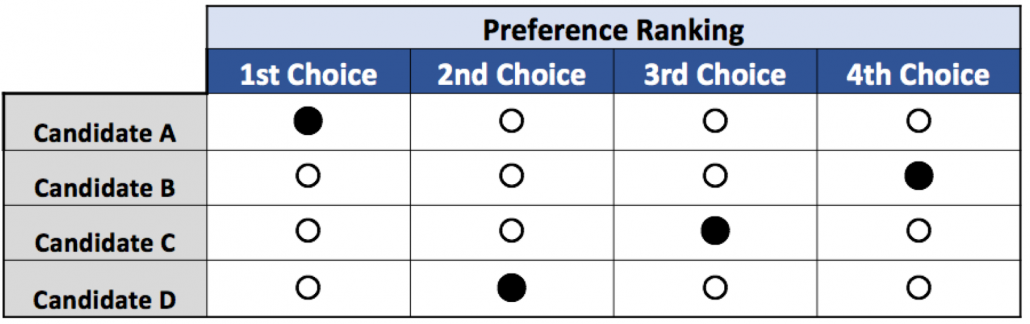

Maine Plows Forward With Ranked Choice Voting

The Maine legislature voted to make it the first state in the United States to use ranked choice voting for presidential electors in general elections. The 2020 election will be the first in which Maine voters will choose their presidential electors in order of preference.

In Maine's version of ranked choice voting, voters rank the candidates from the one they like best to the one they like least. If no candidate gets more than 50% of the vote, the candidate with the lowest number of first ranked votes is eliminated and the totals of those voters second choices are counted as first choices in the vote totals. This continues until one candidate gets more than 50% of first and second choice votes.

The hopes of proponents is that ranked choice voting will stop voting for the "lesser of two evils." If somebody really thinks an independent or alternative party candidate is best, they can vote for that candidate as their first choice and the major party candidate as their second choice without worrying about "stealing" votes from the major party candidate. In theory, there should also be more consensus, as sometimes a candidate who is the second choice of almost everyone will win over a candidate who is a plurality first choice of 30-40% of the voters. For example, it is possible that Ross Perot might have won over Clinton and Bush in a ranked choice voting environment, rather than Clinton electors winning with only 43% of the popular vote. It would have also solved the problem of 2000 Florida presidential election.

A Conscious Conservative is watching this development. Although there is guarded optimism, it is believed that Republicans and Democrats can develop a way to rig the ranked choice system also. Maine is one of only two states that does not select a statewide slate of electors. We will see if Maine selects any electors that are not pledged to the Republican or Democratic Party in 2020.

Sunday, September 29, 2019

Is Republican/Democratic Party Collusion Violating Antitrust Law

According to the Federal Trade Commission website Antitrust Laws--Federal Trade Commission The Sherman Antitrust Act of 1890 outlaws any "monopolization, attempted monopolization, or conspiracy or combination to monopolize."

In a piece written for The Libertarian Republic , William L. Kovacs argues that Sherman and other antitrust legislation applies to the conspiracy created by the Republican and Democratic Parties against alternative party and independent candidates.

Kovacs gives a brief description of why antitrust applies and why common arguments against antitrust made by the two major parties are invalid. He outlines the main legal hurdle as showing how the major parties affect commerce, as most antitrust laws are concerned with restraint of commercial trade. A Conscious Conservative believes that with the current state of government meddling in markets, this should not be too difficult to show. The main hurdle will be that almost all judges are aligned with either the Republican or Democratic Party. I wonder how judges would feel about that as evidence that the two party system is an illegal conspiracy?

Saturday, September 21, 2019

Goldwater Institute Keeps Conservatism Alive

This week I was pleasantly surprised when I received an annual report in the mail from the Goldwater Institute, About the Goldwater Institute . Founded over 30 years ago with the blessings of its namesake, Sen. Barry Goldwater, the Institute carries on the fight for conservative principles in the United States.

A Conscious Conservative found the issues outlined in the report refreshing compared to the faux conservatism spouted by Republican politicians and talking heads on television and radio. Instead of writing about building a wall, there is a remembrance of tearing down the Berlin Wall. Instead of advocating limits on choices in health care, there were articles about expanding care for both physical and mental disorders through limiting government interference.

Here are a few of the initiatives celebrated in this year's annual report.

The Right to Earn a Living -- This allows for licensed professionals to practice in another state without being forced to attend school again and go through an entire licensing process anew.

Right to Try-- This allows terminally ill patients to try any drug available to cure their condition, instead of waiting for years or decades of clinical trials and FDA approval.

Right to Free Speech-- The Institute fought against employees being required to pay dues to unions and lawyers being required to pay dues to bar associations when it can be shown that dues money is used to fund political causes.

Property Rights-- The Goldwater Institute is working on various initiatives to curb the use of eminent domain and stop cities from restricting rentals.

As I look at today's headlines on Fox News Politics about personality clashes over the Ukraine, blackface scandals and war with Iran, it reassures me that somebody like the people at the Goldwater Institute still care about the true conservative issues of "limited government, economic freedom and individual liberty..." that affect all of us.

Saturday, September 14, 2019

Global Tax Cabal Makes Cryptocurrency Its Target

The Joint Chiefs of Global Tax Enforcement (j5) is an international agency created by Australia, Canada, the Netherlands, the United Kingdom and the United States. Their mission, according to the IRS, is to work together to collect taxes worldwide and to fight problems with collecting taxes posed by cryptocurrencies-- IRS-- Joint Chiefs of Tax Enforcement. The member countries believe that it doesn't matter to where in the world you go or with what means you trade. You owe them taxes and they will collect by any means necessary.

The latest action by the j5 is that the member countries have agreed to force digital asset exchanges to turn over personal information on their users. The first member country to do this was the United States, who ordered Coinbase Inc. to turn over their customer database in 2017.

The arrogance of these countries has been documented throughout history. However, A Conscious Conservative believes that it is remarkable that they feel they have the right to collect taxes from anyone. anywhere in the world.

Sunday, September 8, 2019

Governments Fight Against Short Term Rentals

The internet makes renting out you home or apartment easier and more profitable than ever. Entrepreneurs are jumping on this trend. Some see it as more profitable than renting on a long term lease. Others see it as a way to keep a property in a place where they lived formerly, without letting it be vacant. Still others see it as an alternative to a timeshare or a way to make owning a vacation home in a trendy area affordable.

This boom in vacation rentals is bringing out the busybodies and government meddlers of all types. Various local governments are coming up with creative ways to either ban rentals or raise revenue.

Maryville, Tennessee has banned rentals in all areas zoned residential.

San Bernadino County is debating if people can let other people park RVs on their property.

Newton, Massachusetts wants to regulate whether people can rent rooms in their homes.

Denver makes it a felony to temporarily rent out a home that you cannot prove is your "primary residence."

Portland is pressing companies like Airbnb and HomeAway to share data on its users in order to collect extra lodging taxes.

In a surprise move, the State of New Jersey repealed a special short term rental tax under pressure from the NJ Shore Rental Coalition.

As with all private property rights, government should stay out of it except for clear public health and safety issues. Most of these laws are driven by lobbying from either the Real Estate or Hospitality industries. It is another case of where one industry yells foul because government overreach in their industry causes smart entrepreneurs to come up with a creative alternative. The big losers are the people who can make some extra money from renting out their place and the lodgers who can take a dream vacation on a budget.

Saturday, August 31, 2019

Housing Costs: The Ignored Inflation

Politicians and federal reserve members pat themselves on the back for flooding the economy with money without creating inflation. They seem to be turning a willful blind eye to one of the most important expenses for average individuals. Housing. According to US Census Figures, the median home in the United States has risen to almost $200,000 by 2018. That is up from about $120,000 in 2000. According to official inflation data, a median house should be closer to $175,000. That $25,000 is a large difference, because even with today's low interest rates, it means that the average family will be paying $44,000 extra on a 30 year mortgage.

Who gets almost 1/2 of that $44,000 extra? The banks that are pumping extra money into the economy. Do you think that maybe there is a conflict of interests here?

The government makes claims of low inflation because people are paying slightly less for electronic components and other consumer items. Although a person can go without the latest cell phone, just about everybody needs a roof over their head. So when a politician is telling you that they have pumped trillions of phony dollars into the economy with no inflation, look around your neighborhood for what prices homes have been selling. You will find the inflation that they claim is lost.

Saturday, August 24, 2019

Court of Appeals Affirms Presidential Elector Duties

The United States Court of Appeals for the Tenth Circuit has ruled that Presidential Electors have a right to vote their conscience. In the case of Baca v. Colorado Department of State, the court said that Presidential Electors have a "right to cast a vote for President and Vice President with discretion." The court affirmed that once an elector is elected, the Constitution does not allow states to remove an elector from office or nullify his votes. It also stated that individual states do not have the authority to hold any elector to a pledge as to how they are going to vote.

A Conscious Conservative believes that this is a move forward In assuring that Presidential Electors fulfill their duty of voting for the best candidate, not for who the political elite orders. However, work must still be done. In most states, Presidential Electors are not independently chosen but are hand picked political lackeys. Thank you to the brave Plaintiffs in this case, Michael Baca, Polly Baca and Polly Nemanich.

Saturday, August 10, 2019

IRS Could Tax Jeffrey Epstein Sex Abuse Victims

According to a recent change in the IRS tax code , "no deduction is allowed under section 162 for any settlement or payment related to sexual harassment or sexual abuse if it is subject to a non-disclosure agreement." That is IRS speak for unless a victim of sexual harassment is willing to go public, they are subject to income tax. As a general rule, personal injury settlements are not taxable.

Why is Congress and the IRS so interested in outing victims of sexual harassment and abuse? It goes back to an old ruling that only settlements involving physical injuries are tax free. So the IRS only gives a break to those whose sexual abuse includes physical injury and only if this physical injury is made clear in the settlement. Adding extra insult is that the victims must also pay tax on the portion of the settlement that goes to the attorneys. Leave it to the IRS to tax people for money they didn't receive.

A Conscious Conservative believes that Congress should change this code. So far, no bills to attempt the change have gotten any traction at all. Codes like this are just more proof of why the income tax is an arbitrary and barbaric form of taxation. I guess the "evil 1%" includes victims of sexual abuse who get large settlements.

Saturday, August 3, 2019

Arizona Libertarian Appeal Denied

The United States Court of Appeals, Ninth Circuit, has refused to take the case of Arizona Libertarian Party v. Hobbs. The Libertarians were suing to overturn Arizona's ballot access laws. Arizona has some of the most discriminatory laws for alternative party candidates.in the Untied States. Arizona uses a combination of laws to keep candidates from parties other than the Republican and Democratic from appearing on the ballot. There are two laws which especially damage alternative party candidates. The Arizona Libertarian Party plaintiffs were attempting to challenge one of these these laws.

The first law states that only the names of the two largest parties will appear on the voter registration form. That means only the Republican and Democratic Parties have their name on the voter registration form. There is a checkbox which allows people to select one of those two parties. People can register as members of a different party, but must follow a procedure that is not made clear on the form of writing the name of that party on a separate line. This makes it very rare that people register as members of alternative parties, which has swelled the number of independents in Arizona.

The second law states that in order to get on the ballot to be in a primary, a person needs to get a prescribed number of signatures. The barrier is that those signatures must be either members of your party or independents. According to the Arizona Secretary of State, there are about 1,330,000 Republicans, 1,186,000 Democrats and 32,300 Libertarians registered. As far as signatures, a Republican candidate has to get the signatures of about 6400 Republicans, a Democratic Party candidate about 6000 signatures of Democrats and a Libertarian candidate about 3200 Libertarian signatures to be on the ballot.

What do you think is easier, to get 6400 of 1.3 million people to sign a petition or 3200 of 32,000? According to the case records, Libertarian Party candidates had to get the signatures of between 11% and 30% of all registered Libertarians in a given area to qualify to run for office. That compares to a Republican candidate needing the signatures of less than 1/2 of 1% of registered Republicans. The Court appears to put the burden on Libertarian Party candidates to go after independent voters. Of course, there is nothing to stop Republican or Democratic Party candidates from going after that population also. This makes the advantage for Republican and Democratic Party candidates even greater. It is this disparity in percentage of signatures needed which the Libertarian Party was attempting to challenge.

A Conscious Conservative believes that the Republican and Democratic Parties should be held accountable for rigging elections in this manner. While they complain about foreign meddling and voter suppression, they fail to acknowledge that they have created a corrupt system. The results of this system is that nearly 1/2 of voters to not vote in a given election. It is no wonder. Nearly one half of all seats only have one candidate due to ballot restrictions. Why bother to vote when the result is already determined?

Saturday, July 27, 2019

Florida City Boots 103 Year Old Granny

The Florida City of Cape Coral, a suburb of Fort Myers, decided it wants to build a $60 million dollar park. The only barrier is that there are families who have lived on the property for generations. So city officials showed up with a check and said, "Get out!"

Some of the people don't want to leave. According to a story from WINK television, one of these homes has a 103 year old grandmother who isn't interested in moving.

Nancy Wickston, who is a relative of the 103 year old woman, told WINK,

"There's five generations under the same roof and they're all on fixed income basically too." (Full Story Here)

The family is asking for fair market value from the city but feel they won't get it. What they would really like is to live out the rest of their lives in a home which has been in the family for decades.

A Conscious Conservative hopes that the citizens of Cape Coral will come to their senses and get rid of any city council members who are in favor of disrupting the life of a 103 year old grandmother and her family. They can find their contact information at the link below.

Sunday, July 14, 2019

Canada Restricts Crypto

Canada decided that Bitcoin and other crypto-currencies fall under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act this week. Using the usual scapegoat of fighting terrorism, Canada has put restrictions in place for platforms which trade crypto-currency.

Platforms which trade in currency must now register as Money Services Businesses under Canadian law. FINTRAC Policy--Money Services Businesses . They will now be subject to a plethora of regulations. The chief among these being transaction reporting requirements

The primary reporting requirement is any transaction of more than $10,000 CAD (About $7600 US). All "suspicious" transactions are also required to be reported. The definition of suspicious is left to the eyes of the beholder as the Canadian guidelines state "You are in the best position to know what are usual transactions for your business and therefore what is suspicious." This undermines the idea of crypto-currency transactions untraceable and anonymous. Transactions That Must Be Reported

A Conscious Conservative view is that government should get out of the currency regulation business besides issuing money accepted for public debts. Otherwise, people should be free to trade in any means upon which two individuals may agree. Looking for terrorists behind every bush leads to an excess of innocent people getting harassed for conducting respectable business.

Saturday, July 6, 2019

Nevadans Worry About Income Tax

Certain groups in Nevada worry that Nevada may soon have to enact an income tax. The culprit is a law recently signed by Governor Steve Sisolak. The bill allows Nevada State Employees to unionize and engage in collective bargaining. Nevada has long been known as a fiscally conservative state that funds its operation from other tax sources. However, representatives of the Nevada Policy Research Institute NPRI have expressed concern that employees engaged in collective bargaining will lead to run away spending.

"The price tag associated with this is something that really worried us," said NPRI Communications Director Michael Schaus, "simply because we're already straining our budgets." according to an article on the 3 News Las Vegas web site.

Conscious conservatives across the country worry about the natural conflict of interest that occurs when public servants are allowed to hold public interests hostage for salary increases. We also hope that Nevada holds out as one of the examples of how government can be funded without a tax on income.

Saturday, June 29, 2019

Are Democratic Candidates Hypocritical on Voting Rights?

Now that the 2020 election season has officially begun, many candidates who seek the Democratic Party's nomination for president are talking about expanded voting rights.

Bernie Sanders-- "The right to vote is inherent in our Democracy..."

Kamela Harris-- "I agree that the right to vote is one of the very important components of citizenship and it is something that people should not be stripped of needlessly..."

Corey Booker-- It is time for a new Voting Rights Act to finally put an end to systematic attempts to limit the access to the ballot box and strip citizens of their constitutionally guaranteed rights.

The Democratic Party candidates are big on standing up on who gets to vote and seem to want to fight hard to stop anyone from having their right to vote infringed.

There are two major problems. The first is that they want to fight harder to make sure that likely Democrat voters are allowed to vote. The second is that they have not made one statement about for whom people have a right to vote. Democrats are all in favor of letting people who are likely to choose Democrat make a choice between Republican and Democrat. Even the famous Independent Bernie Sanders becomes pure Democrat at presidential election time. He talks about allowing felons to vote, but not about allowing independents or alternative party candidates to run.

In this way the Democrats are very hypocritical. They are all in favor of a person's right to vote, just not their right to have a range of choices for whom to vote.

Saturday, June 22, 2019

Supreme Court Deals Another Blow to Local Government Thieves

The Supreme Court already ruled this year in Timbs v. Indiana that localities which confiscate large amounts of property to enforce petty crimes are violating the constitutional protection against cruel and unusual punishment. On June 21st, the Supreme Court announced a ruling that may further limit local governments' ability to take property. The ruling in the case, Knick v. Township of Scott, Pennsylvania , allows victims of eminent domain to bypass state courts and go directly to federal courts when they feel they have not been quickly and justly compensated.

The Supreme Court already ruled this year in Timbs v. Indiana that localities which confiscate large amounts of property to enforce petty crimes are violating the constitutional protection against cruel and unusual punishment. On June 21st, the Supreme Court announced a ruling that may further limit local governments' ability to take property. The ruling in the case, Knick v. Township of Scott, Pennsylvania , allows victims of eminent domain to bypass state courts and go directly to federal courts when they feel they have not been quickly and justly compensated.

The opinion, written by Chief Justice Roberts, has a very interesting passage. It goes, "...The Fifth Amendment right to full compensation arises

at the time of the taking, regardless of post-taking remedies that may be available to the property owner..." For those not familiar with such procedures, in many parts of the country property is taken without either no or inadequate compensation. Then local government uses a long, expensive court process for the property owner to sue for compensation. Many property owners give up because attorney's fees, filing fees, time and effort to receive compensation may exceed the property's value.

Justice Thomas wrote something even more interesting in a concurrent opinion,

----This “sue me” approach to the Takings Clause is untenable. The Fifth Amendment does not merely provide a

damages remedy to a property owner willing to “shoulder

the burden of securing compensation” after the government takes property without paying for it... ----

Although not actually saying it, Justice Thomas hints at the absurdity of a person having to file suit to get paid in a court where the judge knows some of their compensation comes from the seized property.

The combination of the Timbs and the Knick cases seem to indicate that the Supreme Court is moving in the right direction with regards to the relationship of government vs. private property rights. Although these recent decisions don't completely undo the damage from the Kelo ET AL. v. City of New London ET AL case, it gives hope that the Justices may be considering the overreach that local governments have exercised in the realm of unjust property confiscation.

Sunday, June 16, 2019

Contra Costa County Takes $1.1 million From People Who Committed No Crime

Over the last four years, Contra Costa County (CA) has taken more than $1 million dollars worth of cash and property from people who were never charged with crimes according to the Mercury News . This is just legalized theft.

To her credit, Diana Becton, the District Attorney for Contra Costa County is considering re-writing the rules. She wants to make it more difficult for police to seize property unless charges are filed. However, it sounds like her proposal is $1.1 million too late.

Civil asset forfeiture is supposed to be used as a tool by law enforcement to make sure that crime doesn't pay. However, in too many places lack of crime is paying off for the police. The US Supreme Court recently ruled that civil asset forfeiture for convicted people is subject to the "cruel and unusual punishment" test. It remains to be seen how this ruling affects people who have never been charged with a crime.

The procedure in California is similar to that in many states. People who feel their property has been unjustly seized have the right to request a court hearing in order to get their property returned. That is completely backwards. The state should be required to prove in a hearing that they have the right to keep the property. If a person has never been charged with a crime, the ruling should be automatic. Give the seized property back.

Sunday, June 9, 2019

Federal Reserve Caught In Its Own Trap

In reaction to the market crash that followed the banking crisis of the late 2000s, the Federal Reserve cut interest rates to historically low levels. The idea was that injecting cheap money into the economy would raise stock prices. It worked. The problem is that it has now gone too long. As Sven Henrich, the lead market strategist at Northman Trading and contributor to various financial publications states in Marketwatch, "We are witnessing a historic unraveling here." What is happening is an ever increasing dependence on debt to increase stock market values. Even the slightest hint of an interest rate increase causes a dip in the market. What is unprecedented is that the Federal Reserve seems to react to these dips. If an increase is announced and markets dip, a FED Spokesman runs out to a press conference and says, "Just Kidding." The latest turn around prompted CNBC to run with a headline on Friday of "It's no longer a question of if the Fed will cut interest rates, but when." A major problem is that other central banks must follow the Fed's lead. This has created a world debt crisis that is unsustainable.

Nobody can predict when, but two outcomes are certain and one is probable. The first certain outcome is that the current period of economic growth will come to an end. Some, like Henrich, believe it has come already but that Fed promise of easy money is delaying the inevitable. However, delaying the end of economic growth historically means rather than growth ending, we have create a crash. Although demographic factors indicate this may not happen soon, a deep recession may be in our future. The second certain outcome is inflation. The way government calculates inflation was changed in 2015 so that inflation is not as evident in official figures. Everyone who buys gas for the vehicles and groceries for their bellies notices the effects of inflation over the last ten years. It can only get worse if easy money continues to be available. The probable outcome that may not happen is that the Federal Reserve Board of Governors may be forced to "wake up" as it did in the late 1970s. To stave off the debt and inflation crises, it may over tighten. Millennials do not remember 18% interest rates on home mortgages, or even 8% interest rates. It is difficult to predict how they will react.

There is a way to avoid all of this. Stop the system of currency manipulation and return to a system of sound money. It is doubtful that the bankers will want to give up the power to make markets go up and down.

Saturday, May 25, 2019

Funding Government Without An Income Tax

Before the advent of the Income Tax, the United States government was funded by a series of taxes under the heading of ad valorem taxes Overview of Ad Valorem Taxes . Ad valorem means "to value" in Latin and ad valorm taxes are taxes based on the value of various business transactions. At the local government level, ad valorem taxes are also sometimes levied on ownership of certain types of personal property, like land, buildings or vehicles. At the federal level, the United States did not tax property, only the value of imports and transactions of certain products. like alcohol and tobacco. The ad valorem tax is still used in the United States. They fund public education, police and fire departments in many local areas and make up a good portion of current federal government revenues.

Before the advent of the Income Tax, the United States government was funded by a series of taxes under the heading of ad valorem taxes Overview of Ad Valorem Taxes . Ad valorem means "to value" in Latin and ad valorm taxes are taxes based on the value of various business transactions. At the local government level, ad valorem taxes are also sometimes levied on ownership of certain types of personal property, like land, buildings or vehicles. At the federal level, the United States did not tax property, only the value of imports and transactions of certain products. like alcohol and tobacco. The ad valorem tax is still used in the United States. They fund public education, police and fire departments in many local areas and make up a good portion of current federal government revenues.

Why are ad valorem taxes more desirable? Ad valorem taxes were much more voluntary. There is no requirement that a person or business import goods from other countries, or sell alcohol or tobacco, to survive. In the modern world, people need some form of income to survive. Taxing income in the 21st Century is like taxing breathing or eating. Ad valorem taxes also can be designed to match the tax to the government service more closely. An example of this was when highways were funded with taxes on gasoline and vehicles. More gasoline and vehicles purchased meant both more need to build highways and more revenue to build highways. Not only is taxing somebody who walks everywhere to build a highway they will never use unjust, it leads to decisions like the famous "Bridge to Nowhere Scandal."

The time is now to transition the United States back to its roots. For 170 years, ad valorem, not income taxes, were the primary funding mechanism for the federal government. It should be so again.

Saturday, May 18, 2019

California Attempts to Limit Presidential Candidates

According to a recent article in New York Magazine , the California Senate passed a bill which may have sweeping effects on presidential elections. Targeted at president Trump, the bill requires presidential candidates to release five years of personal income tax returns in order to be placed on presidential primary ballots. As many as 24 other states are contemplating similar laws.

There is a question as to whether such a law is constitutional. As a general rule, individual states are not allowed to add qualifications for president not outlined in the Constitution. That is why there are several states where there will be a presidential candidate representing an alternative party, but no other candidates of that party for other office on the ballot. If it is allowed, expect similar bills in other states that will have the requisite "does not apply" to the "two largest parties."

Conscious Conservatives are in favor of ballot access for all candidates that meet the basic qualifications outline in the Constitution. Manipulation and game playing with the voting process by the Republican and Democratic Parties must stop.

Tuesday, May 14, 2019

Pipeline Companies Find Loophole to Take Land for Free

According to an article posted this week in on the Forbes Magazine website, the Institute for Justice is asking the U.S. Supreme Court to end pipeline companies' practice of taking private owners land without paying for it.

It works like this. A pipeline company makes a low ball offer on a piece of private property. The property owners refuse to accept the offer. Then the pipeline company gets a court order to take the property using eminent domain, with a fair market purchase price to be determined later. The pipeline company builds the pipeline, but never pays the fair market price.

The case highlighted in the article is that of Gary and Michelle Erb. Gary and Michelle own 72 acres in the Susquehanna Valley (Lancaster County Pennsylvania). The Transcontinental Gas Pipe Line Company (Transco) got a court order to put a pipeline through their property, 400 feet from their front door in 2015. The pipe line has long been built and oil is flowing, but the Erb family has not received a cent for their land.

All Conscious Conservatives should hope that the Institute for Justice prevails and that this legalized theft is stopped.

It works like this. A pipeline company makes a low ball offer on a piece of private property. The property owners refuse to accept the offer. Then the pipeline company gets a court order to take the property using eminent domain, with a fair market purchase price to be determined later. The pipeline company builds the pipeline, but never pays the fair market price.

The case highlighted in the article is that of Gary and Michelle Erb. Gary and Michelle own 72 acres in the Susquehanna Valley (Lancaster County Pennsylvania). The Transcontinental Gas Pipe Line Company (Transco) got a court order to put a pipeline through their property, 400 feet from their front door in 2015. The pipe line has long been built and oil is flowing, but the Erb family has not received a cent for their land.

All Conscious Conservatives should hope that the Institute for Justice prevails and that this legalized theft is stopped.

Sunday, April 21, 2019

Texas Builds Its Own Fort Knox

According to the Austin Business Journal, construction is underway for a permanent building for the Texas Bullion Depository. The Depository was created by the State of Texas is an alternative to Federal Reserve storage of gold, silver, platinum and other precious metals. Deposits are overseen by the Texas Comptroller for Public Accounts.

The initial facility will be 40,000 square foot, enough to store about $350 billion in precious metals. There are plans to more than double the facility if there is a market. Texas is trying to encourage large institutional investors in the state, like the University of Texas system, to move their precious metals holdings from The Fed to the state depository. Currently any U.S. citizen, resident or corporation can open an account and store precious metals at the Depository.

This is an interesting move by Texas. According to Gregg Abbott, the Texas Governor who signed the bill creating the Texas Bullion Depository, the Depository's purpose is "... increasing the security and stability of our gold reserves and keeping taxpayer funds from leaving Texas to pay for fees to store gold in facilities outside of our state." It will be interesting to see if other states follow in establishing precious metal depositories. It will also be interesting to see if the Federal Reserve pushes back if Texas starts to get a significant amount of their deposits.

Sunday, April 14, 2019

History of Tax Day

Tomorrow is Tax Day again. That is the day which is the deadline to file an annual income tax return in the United States. In honor of tax day, let's look at the history of tax rates.

The biggest thing that should be noted is that for most of the history of the Untied States, there was no income tax. It is not an inevitable part of funding a government. For an even longer period of more than 150 years, there was no or minimal income tax on the average person.

I chose two marginal rates to track. The first is the hypothetical income of $10 million dollars which has been bandied about by politicians lately. This group of "the rich" has often been the target for income taxes. The other group at which I looked was those with a medium income rate. One of the ways in which taxes were sold by politicians was that for the first couple of generations, the median earner paid little to no income tax. The taxes were then raised with the justification of paying for the World Wars. Taxes went up briefly after World War I and came down again for the average worker. It went up again after World War II and did not come down significantly until 2018. The income tax became a regular feature of middle class life.

The figures below are using inflation adjusted incomes. For most of the period, $10 million dollars of income placed a person in the top bracket. However, in some of the earlier years it didn't. The biggest change in what median earners paid came in the 1950s. Several things happened in that decade. The main ones were that the income tax became the main source of federal funding in the 1950s. The other is that household composition began to determine tax rate. Rather than a single percentage based on income, there became a range of percentages paid based on factors like married or single, parents or childless.

Here are the ranges throughout history:

$10,000,000 Income Median Income

Before 1913 No Income tax No Income Tax

1913 6% No Income Tax

1920 72% 8%

1930 25% 1 1/2 %

1940 74% 4%

1950 91% 30%

1960 91% 22%-26%

1970 70% 22%-32%

1980 70% 28%-49%

1990 28% 28%

2000 39.6% 15%-27.5%

2010 35% 15%-25%

2018 37% 12%-22%

The biggest thing that should be noted is that for most of the history of the Untied States, there was no income tax. It is not an inevitable part of funding a government. For an even longer period of more than 150 years, there was no or minimal income tax on the average person.

I chose two marginal rates to track. The first is the hypothetical income of $10 million dollars which has been bandied about by politicians lately. This group of "the rich" has often been the target for income taxes. The other group at which I looked was those with a medium income rate. One of the ways in which taxes were sold by politicians was that for the first couple of generations, the median earner paid little to no income tax. The taxes were then raised with the justification of paying for the World Wars. Taxes went up briefly after World War I and came down again for the average worker. It went up again after World War II and did not come down significantly until 2018. The income tax became a regular feature of middle class life.

The figures below are using inflation adjusted incomes. For most of the period, $10 million dollars of income placed a person in the top bracket. However, in some of the earlier years it didn't. The biggest change in what median earners paid came in the 1950s. Several things happened in that decade. The main ones were that the income tax became the main source of federal funding in the 1950s. The other is that household composition began to determine tax rate. Rather than a single percentage based on income, there became a range of percentages paid based on factors like married or single, parents or childless.

Here are the ranges throughout history:

$10,000,000 Income Median Income

Before 1913 No Income tax No Income Tax

1913 6% No Income Tax

1920 72% 8%

1930 25% 1 1/2 %

1940 74% 4%

1950 91% 30%

1960 91% 22%-26%

1970 70% 22%-32%

1980 70% 28%-49%

1990 28% 28%

2000 39.6% 15%-27.5%

2010 35% 15%-25%

2018 37% 12%-22%

Sunday, March 24, 2019

Representative Amash Sponsors Fair Election Bill

Representative Justin Amash (R- MIch.) introduced bill HR 1681 earlier this month. The bill description sates, "To require States to impose the same ballot access rules on all candidates in a general congressional election held in the State without regard to whether or not the candidates are nominees of a political party..." Currently, candidates for the Republican and Democratic parties get a myriad of advantages over other candidates in most states. In many states, no candidates but those of the Republican and Democratic party have a reasonable chance of even getting their name listed on the ballot. For example, no third party candidate has appeared on the ballot for U.S. House of Representatives in Georgia since its current ballot access laws were passed in 1943.

Hopefully this bill will pass and get rid of "two largest" laws that exist across the country. "Two largest" laws are always which state that candidates of the two largest parties, as determined by voter registration or prior election performance, get all sorts of advantages over other candidates. These range from ability to put future candidates on the ballot or preferential placement on the ballot to public funding.

The bill has been referred to the House Committee on House Administration. The bill can be tracked here:

H.R.1681: To require States to impose the same ballot access rules on all candidates

Hopefully this bill will pass and get rid of "two largest" laws that exist across the country. "Two largest" laws are always which state that candidates of the two largest parties, as determined by voter registration or prior election performance, get all sorts of advantages over other candidates. These range from ability to put future candidates on the ballot or preferential placement on the ballot to public funding.

The bill has been referred to the House Committee on House Administration. The bill can be tracked here:

H.R.1681: To require States to impose the same ballot access rules on all candidates

Saturday, March 16, 2019

Court Rules That Delaware Must Allow Independent Judges

The Third Circuit Court of Appeals ruled that Delaware cannot require its judges to be members of a major political party (Adams v. Governor of Delaware, 18-1045). Delaware law stated that all Supreme Court Justices, plus all Superior and Chancery Court Judges must be members of the Republican or Democratic Parties. Delaware argued that this should be allowed because there were both Republican and Democratic judges. The Third Circuit ruled that no state may hire anyone based on political affiliation.

One of the cornerstones of keeping the two party system in power is having partisan judges and elections officials. It is difficult for independent or alternative candidates to get a fair shot at elections when the elections officials are members of an opposing party. Add that the judges who hear their ballot discrimination cases are also partisan and it is little wonder as to why the two major parties control the election process.

Judge Julio Fuentes, who had the courage to write this decision as well as the judges who supported it, Theodore McKee and L. Felipe Restrepo should be applauded for making a decision outside of partisan affiliations.

One of the cornerstones of keeping the two party system in power is having partisan judges and elections officials. It is difficult for independent or alternative candidates to get a fair shot at elections when the elections officials are members of an opposing party. Add that the judges who hear their ballot discrimination cases are also partisan and it is little wonder as to why the two major parties control the election process.

Judge Julio Fuentes, who had the courage to write this decision as well as the judges who supported it, Theodore McKee and L. Felipe Restrepo should be applauded for making a decision outside of partisan affiliations.

Sunday, March 3, 2019

Supreme Court Rules Against Police Shakedowns

In a rare unanimous decision, the Supreme Court ruled that the practice by local governments of seizing property and using excessive fines to fund government operations was a violation of Eighth Amendment protections. Timbs v. Indiana

In this particular case, Indiana had taken a Range Rover (value about $42,000) from Timbs when he was accused of a minor drug charge. This practice, known as civil forfeiture, has been used by law enforcement to confiscate billions of dollars worth of property from citizens. Originally sold as a method to undermine the financial structures of large criminal organizations, in many jurisdictions this method is merely used to pad law enforcement coffers. Some jurisdictions do not even require that formal charges be filed or a crime be proven in order to seize property.

In Mr. Timbs case, he did plead guilty. However, the Supreme Court determined that taking the Land Rover was "grossly disproportionate to the gravity of Timb's offense."

It appears that this case deals mainly with the amounts which may be seized rather than attacking the act of seizure itself. Hopefully another case will make it to the court which protects the rights of people who have property seized who have not been charged with criminal acts. So far all of these cases of which A Conscious Conservative is aware have been settled out of court at lower levels. It will be interesting to see how states adjust their policies with regards to this ruling.

In this particular case, Indiana had taken a Range Rover (value about $42,000) from Timbs when he was accused of a minor drug charge. This practice, known as civil forfeiture, has been used by law enforcement to confiscate billions of dollars worth of property from citizens. Originally sold as a method to undermine the financial structures of large criminal organizations, in many jurisdictions this method is merely used to pad law enforcement coffers. Some jurisdictions do not even require that formal charges be filed or a crime be proven in order to seize property.

In Mr. Timbs case, he did plead guilty. However, the Supreme Court determined that taking the Land Rover was "grossly disproportionate to the gravity of Timb's offense."

It appears that this case deals mainly with the amounts which may be seized rather than attacking the act of seizure itself. Hopefully another case will make it to the court which protects the rights of people who have property seized who have not been charged with criminal acts. So far all of these cases of which A Conscious Conservative is aware have been settled out of court at lower levels. It will be interesting to see how states adjust their policies with regards to this ruling.

Sunday, February 17, 2019

The Payroll Deduction Scam

One of the biggest frauds of the income tax has been recently brought to light by changes in the tax code. Because less money was withheld from many people's paychecks last year, people are getting smaller tax refunds. Some are even owing taxes when they file. The response to this in articles about the subject shows the complete ignorance on how the process works. NPR had a February 14th headline of "Anger, Confusion Over Dwindling Tax Refunds. Is Trump's Tax Plan To blame?" The Worcester (MA) Telegram writes "Reduced tax refunds surprise Bay State taxpayers," on February 15th. Some people are complaining that they are getting smaller refunds. Others that owe say they do not have enough money to pay.

This is because the government of the United States has set up a scam. Although the money goes to the government, it is taken out of paychecks by employers. Typically the government takes more than is expected throughout the year. Then, at the end of the year, people get a refund of the overpayment. This sets up the government as one giant gift giver. The IRS sends out millions of checks each spring. As can be seen by the reaction of people who aren't getting checks this year, this is seen as free money. Most don't realize that they have paid too much throughout the year.

There is a simple way to stop this fraud. Eliminate payroll withholding. This would be a boon to businesses small and large who spend an inordinate amount of time collecting money on behalf of the federal and state governments. Having people send a payment on a regular basis would ingrain in them how much of their money is actually being taken. It would also dissuade any notion that the government is in the business of handing out checks each spring.

This is because the government of the United States has set up a scam. Although the money goes to the government, it is taken out of paychecks by employers. Typically the government takes more than is expected throughout the year. Then, at the end of the year, people get a refund of the overpayment. This sets up the government as one giant gift giver. The IRS sends out millions of checks each spring. As can be seen by the reaction of people who aren't getting checks this year, this is seen as free money. Most don't realize that they have paid too much throughout the year.

There is a simple way to stop this fraud. Eliminate payroll withholding. This would be a boon to businesses small and large who spend an inordinate amount of time collecting money on behalf of the federal and state governments. Having people send a payment on a regular basis would ingrain in them how much of their money is actually being taken. It would also dissuade any notion that the government is in the business of handing out checks each spring.

Saturday, February 9, 2019

San Francisco Fed President Ponders Permanent Easing

Both Reuters and Bloomberg are now reporting that San Francisco Fed President Mary Daly is talking about making Quantitative Easing a permanent program. Although she spoke with the usual timidity of a Federal Reserve official, Daly admitted that more frequent use of Easing was being discussed.

There are two main problems that can be caused by this intervention in the economy. The first is that flooding the markets with money can cause horrible inflation. Since this inflation is related to easy money rather than economic growth, it can become the dreaded stagflation. In stagflation, prices rise but wages remain stagnant and unemployment can increase. The other problem is that inflation lowers personal savings rates and investment by individuals. When money is becoming less valuable by the day people spend their money before the prices go up. When banks have easy money they can lend at very low interest rates and less stringent underwriting. That pushes private lenders out of the market. The low interest environment is especially hard on the retired which rely on CDs and bonds for income as well as pension funds which rely on a low risk, stable lending portfolio for sure and steady returns.

We can hope that those running The Fed have more sense than to make Quantitative Easing a mainstay of intervention. However , recent decades have shown that decisions are often made more to benefit the member banks and the stock market than the people of the United States. The market rallied moments after Daly's statements were released. We will have to wait and see.

Saturday, February 2, 2019

Law Enforcement or Simply Theft?

The Greenville News (Greenville South Carolina) recently did an investigation of property seizure by South Carolina police agencies TAKEN: How police departments make millions by seizing property.) They found that "Police are systematically seizing cash and property... netting millions of dollars each year." They came to the conclusion that "South Carolina law enforcement profits" from these seizures.

How does this happen in the United States? The Fourth Amendment clearly states that "The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no warrants shall issue, but upon probably cause, supported by oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized." Because of the profits involved, states have been playing fast and loose with this definition of "probable cause." Many use the standard of any suspicion that a crime might be committed. Here is a sample from the North Dakota Century Code (29-31.1) "Forfeiture is a civil proceeding not dependent upon a prosecution for, or conviction of,

a criminal offense..." Since it is a civil proceeding, many of the important protections against taking of personal property are absent including guilt beyond a reasonable doubt.

It is time for citizens to demand a stop to this practice. Seizing ill gotten gains from individuals who have been CONVICTED of a crime can be a valuable law enforcement tool. Allowing police to take property on suspicion is merely sanctioned armed robbery.

Sunday, January 27, 2019

It's Tax Time Again

It is the time of year again when people start to pay tribute to their master in the form of the Income Tax. Not only do people have to pay the government, but they spend valuable time telling the government how much they have to pay. The average person spends 8 hours to prepare their tax return. The IRS gets this free labor out of people because it tricks most into paying too much throughout the year. Then people have to justify getting their own money back.

This year will probably take more time. Why? Because the rules have changed. The 2018 Tax Reform changed what is deductible, what isn't and what is but not like it used to be. As usual, the IRS has printed a publication IRS Publication 5307 Tax Reform Basics for Individuals and Families . With its typical simplicity, the basic publication is twelve pages long and contains phrases like: "federal law controls the characterization of the payments for federal income tax purposes regardless of the characterization of the payments under state law."

The Republicans blew their chance as usual. They could have greatly simplified the tax code when they controlled both chambers of Congress and the presidency. Instead, they bowed to the usual suspects and used the tax code to reward friends and punish enemies. They made the code more complicated, not less. So now people will be spending more of their valuable time learning new rules and filing to get money back that belongs to them in the first place. It is time for real tax reform. Let's start the debate with a flat income tax rate for everyone of 0%.

Saturday, January 19, 2019

Jesse Ventura Goes Green?

Several news outlets have reported that former professional wrestler, actor and Governor of Minnesota Jesse Ventura is considering both a return to the ring and a run for President of the United States. There is a Facebook page Jesse Ventura for President devoted to his run as a Green party candidate. If Ventura runs, it will be interesting to see both the effects on the election and on the Green Party.

Although the Green Party was founded primarily on environmental issues and core principles such as Grass Roots Democracy and Ecological Wisdom Green Party US-- Ten Key Values , the US branch has become a haven for radical socialist Expats from the Democratic Party. The Jill Stein presidential campaign went far afield of the Green core values into the territory of minimum wage and "LGBTQEA+" issues.

Will Ventura embrace the core Green principles of environmental wisdom and local political control and bring the Green Party back to its core? Or will Ventura continue to press his own populist issues, like marijuana legalization and tax reform? Would his personality bring enough new people into the Green Party to alter the party's future?

It will be very interesting if he runs. Especially if he can get enough ballot access and support to rattle the Republican Party and Donald Trump.

Subscribe to:

Posts (Atom)

-

The Federal Reserve has went into another round of quantitative easing, but outside of some financial news sources, the press seems to b...

-

The Supreme Court has decided to take up an issue that goes to the heart of the United States election process. There have been conf...

-

The Great Depression of the 1930s stands as one of the most tumultuous chapters in economic history. While many factors contributed to the s...

ARE YOU A CONSCIOUS CONSERVATIVE?

You may be A Conscious Conservative if you believe: No person or government has a right to take or use a person's property without t...